If the situation ever improves, the board of directors will then authorize that a portion or all of these dividends be paid. Once the authorization is made, these dividends appear in the balance sheet of the issuing entity as a short-term liability. When paid, dividends in arrears go to the current holder of the related preferred stock.

What is cumulative preferred stock?

If the company chooses not to pay dividends in any given year, the shareholders of the non-cumulative preferred stock have no right or power to claim such forgone dividends at any time in the future. If a company is struggling and has to suspend its dividend, preferred shareholders may have the right to receive payment in arrears before the dividend can be resumed for common shareholders. If a company has multiple simultaneous issues of preferred stock, these may in turn be ranked in terms of priority. The highest ranking is called prior, followed by first preference, second preference, etc. Unlike common stockholders, preferred stockholders have limited rights, which usually does not include voting. Preferred stock combines features of debt, in that it pays fixed dividends, and equity, in that it has the potential to appreciate in price.

Does a company have to pay dividends in arrears?

It is calculated as the difference between securitized mortgage interest and interest on financial liabilities from securitization. Investors interested in generating cash flow from their equity holdings may be better suited holding preferred equity or preferred stock. This type of equity investment represents ownership of a company and results in prioritized treatment for dividend distributions.

- Preferred stock issuers tend to group near the upper and lower limits of the creditworthiness spectrum.

- If you miss an undeclared stock dividend, you disclose the dividend in arrears as a footnote on the balance sheet.

- The prospectus will state the annual dividend payment in the offering summary.

- Because these institutions buy in bulk, preferred issues are a relatively simple way to raise large amounts of capital.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Preferred Stock: What it Is, How it Works

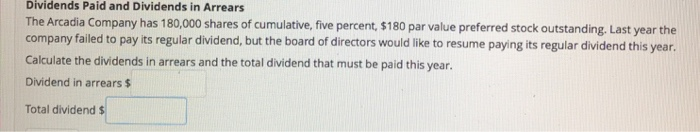

This dividend is usually paid quarterly, so divide it by four to arrive at the expected quarterly payment. Then multiply this amount by the number of dividend payments that the issuer missed. This outcome is the amount that the issuer is required to pay before any dividends can be paid to the holders of its common stock. When a stock dividend is declared, the total amount to be debited from retained earnings is calculated by multiplying the current market price per share by the dividend percentage and by the number of shares outstanding. If a company pays stock dividends, the dividends reduce the company’s retained earnings and increase the common stock account.

Perpetual Preferred Stock

Preferred shares may be callable where the company can demand to repurchase them at par value. Second, preferred stock typically do not share in the price appreciation (or depreciation) to the same degree as common stock. The inherent value of preferred stock is the ongoing cash proceeds that investors receive. However, because they are not tied to semi-fixed payments, investors hold common stock for the potential capital appreciation.

However, given the size of its pressing financial obligations, it is still unable to pay its preferred dividends. An amount on a loan, cumulative preferred stock or any credit instrument how to determine what to pay an employee at your small business that is overdue. Preferred shares usually do not carry voting rights, although under some agreements, these rights may revert to shareholders who have not received their dividend.

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information reflects management’s current beliefs and is based on information currently available to management. Based in St. Petersburg, Fla., Karen Rogers covers the financial markets for several online publications. She received a bachelor’s degree in business administration from the University of South Florida.

At the end of the third year, the board of directors declares and pays a $1,500 dividend. Since there is a $3,000 balance in the arrears account (including year three’s balance), cumulative preferred shareholders are paid first. The entire $2,500 payment goes to cumulative shareholders and reduces the arrears account to $500. Non-cumulative preferred stock does not issue any omitted or unpaid dividends.

Dividends in arrears are also known as accumulated dividends or arrearages. Ask a question about your financial situation providing as much detail as possible. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.